Two sides of the coin: cash usage in New Zealand

20 May 2016

New, bright and highly secure $20, $50 and $100 notes will be lining the pockets of Kiwis around the country as the old notes pass into obsolescence.

While the Reserve Bank’s upgrade of New Zealand’s currency was primarily about updating security to prevent counterfeiting, there has been public debate about whether or not New Zealand is becoming a cashless society.

This marks a good opportunity to examine how New Zealanders use cash today, particularly given the significant advancements in electronic payments technology – and our swift adoption of them.

There are two sides to the conversation about cash use in New Zealand.

This article will look at the inevitability, or otherwise, of a cashless society, focusing on the evolution of cash as a payment method and New Zealanders’ philosophical and emotional relationship with cash as an asset.

The next article in this two-part series will discuss the implications of our use of cash looking at the arguments for and against a cashless society.

Two main purposes of cash

Whether a cashless society is achievable, realistic or a good or bad thing is a source of much debate.

First, let’s be clear on what people mean when they say ‘cashless society’. A ‘cashless society’ is referred to as being able to operate without cash, using only electronic payment means1. Therefore, a ‘cashless society’ would be better described as one with less cash, rather than no cash.

The use of cash in New Zealand differs depending which of its two main purposes you look at:

- Cash can be used to store value – it is an asset. This is commonly referred to as hoarded cash and is a form of savings.

- Cash can be used to pay for things – as a way of exchanging value. This cash acts as New Zealand’s active float and is frequently being exchanged.

Breaking down cash use in this way, allows us to have a more informed discussion about the drivers of payment choice in New Zealand.

Cash as payment

Payments NZ analysis shows New Zealanders’ use of cash as a payment method is far from uniform. Factors such as age, culture, anonymity and level of confidence with technology all appear to influence our payment preferences including whether or not we use cash.

Due to cash’s anonymity, cash payments can be notoriously hard to measure. On this basis, Payments NZ has obtained data from some NZ retailers that help examine the use of cash in making payments in the New Zealand context.

This data reveals that one of the most significant factors in determining the use of cash over other payment methods is related to a person’s wealth. The more affluent you are, the more likely you are to pay for things electronically, by card or mobile phone. Conversely, people from lower socio-economic groups seem more likely to use cash to pay for things.

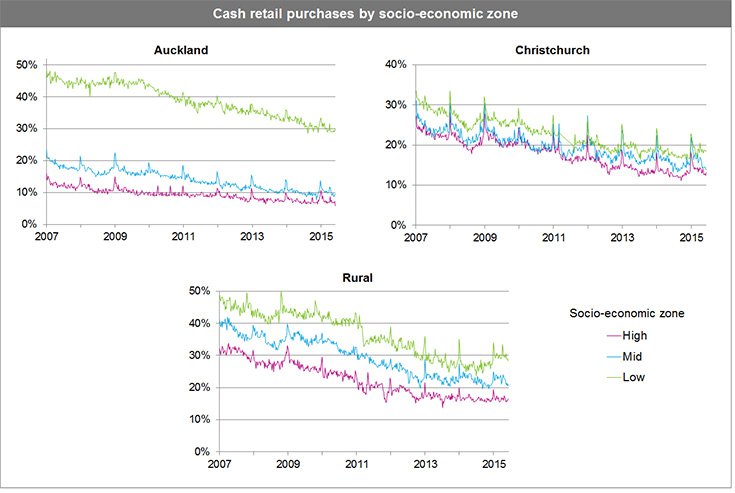

The charts below show the percentage of retail sales that were paid in cash across different stores located in high, medium and lower socio-economic areas of Auckland, Christchurch and rural New Zealand. Auckland shows affluent areas taking in very low levels of cash sales (less than 10%), whereas lower socio-economic areas of Auckland have approximately 30% of sales in cash.

While there is variation in cash usage by different socio economic groups in our society, there is a very clear overall trend that cash as a payment method is in decline. This trend can be seen across New Zealand, but is more apparent in Auckland.

The paradox of banknotes: Increasing cash in circulation

Despite the decline of cash as our payment method of choice, evidence from both New Zealand and around the world shows that cash in circulation is steadily growing, seemingly negating arguments that a cashless society is near.

Last October, with the release of the new $5 and $10 bank notes, the Reserve Bank’s head of currency Brian Hayr reported that the year to June 2015 saw cash in the hands of the New Zealand public jump 7.6 percent.

This increase of cash in circulation, despite the uptake of more convenient and efficient payment options, has been described as

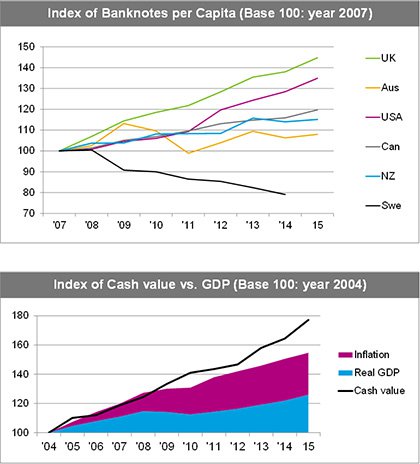

the ‘paradox of banknotes’. This is a global phenomenon where “banknotes in circulation continue to rise, but their use in transactions is falling”2. Payments NZ’s analysis shows that New Zealand is consistent with this global trend – our cash in circulation since 2004 has increased at a rate almost three times NZ’s GDP, and approximately 50% faster than inflation.

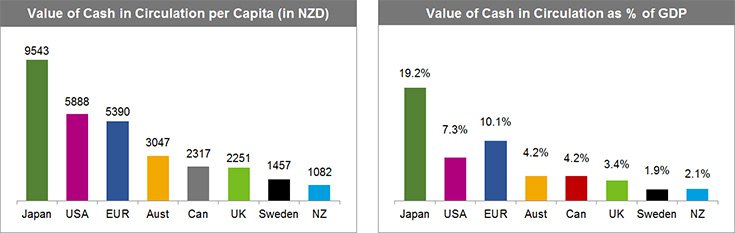

While New Zealand is following the global trend of increasing cash in circulation, New Zealand’s total cash in circulation is amongst the lowest in the world on a per capita basis and as a percentage of GDP3.

Reasons for an increase in banknotes are varied and do not imply that a cashless society is any less likely. It means that the ways people use cash are complex. One of the main drivers of an increase in cash in circulation is the hoarding of cash which speaks to the other side of the cash usage in New Zealand – cash as an asset.

Cash as asset

As our definition stated, cash as an asset, or a way to store value, is commonly referred to as hoarded cash and is a form of savings.

We can only speculate as to the reasons people hoard cash, but factors could include population growth, an evolving cultural diversity mix, an ageing population, the size of the informal economy, black market activity, and our levels of financial inclusion and financial literacy.

In his article ‘The dirty secrets of NZ’s $100 bills’ written earlier this year, business journalist Rob Stock speaks to the role the underground economy in cash hoarding. Stock cites former head of the Standard Chartered Bank Peter Sands’ idea that high denomination notes are being used more frequently to service the underground economy.

Research seems to support this argument revealing the $100 banknote has been growing in popularity in New Zealand. The total value of $100 notes held by the public rose 184 per cent from $648m to $1.84b, between the years 2000 and 2015.

This piece by Rob Stock sparked a lot of public feedback, which in itself highlights New Zealanders’ strong relationship and perceived ‘right’ to cash.

Cash as an asset, and access to cash, is intimately linked with the dual concepts of freedom and independence. These concepts appear in all sorts of ways – for example, fears of finanical institutions collapsing or in the perceived need to have cash reserves in an emergency. It is an emotive discussion fuelled by recent events such as the collapse of the Greece’s economy and the wider Global Financial Crisis.

Conclusion

While it is important to recognise New Zealanders’ emotional relationship with cash in any discussion around a shift towards a cashless society, the reliance on electronic payments is certainly greater. New Zealand’s efficient and extensively used electronic payment systems mean cash is being used less to pay for things and this logically leaves us with a hypothesis that cash asset hoarding is the driver of our increasing cash in circulation.

The economic, behavioural and emotional drivers of payment choice covered in this article are all important parts of the debate around a transition to a cashless society. It is important each is considered in terms of the broader drivers of payment choice in New Zealand.

Look out for the next article in this two-part series on cash out next week called ‘Implications of a cashless society for NZ’.

And if you want to see how other payment methods stack up in New Zealand, see our recent infographic NZ payments stats - a year in review.

Footnotes:

1. The Oxford Dictionaries define ‘cashless society’ as: “Characterized by the exchange of funds by cheque, debit or credit card or electronic methods rather than the use of cash”.

2. Bank of England (6 December 2009) Banknotes in Circulation: Still Rising: What Does This Mean for the Future of Cash?

3. Payments NZ (1 April 2015) Are our payment systems as good as we think they are?