Solving the identity puzzle

4 Aug 2017

Last week we ran a seminar on digital identity. This was led by David Birch, Director of Innovation at Consult Hyperion (who also presented at our conference The Point 2016), Andre Boysen, Chief Identity Officer at SecureKey and Chuck Hounsell, SVP of Payments at Toronto-Dominion Bank. They presented attendees with the puzzle of digital identity, and one potential solution that’s being rolled out in Canada following collaboration between key industry players.

David opened the seminar with a simple hypothesis: if you know who everyone is, payments are easy. However, knowing this requires an extensive and secure identity infrastructure. Banks have an opportunity to lead the development of this infrastructure given they hold a great deal of technical expertise and consumer trust.

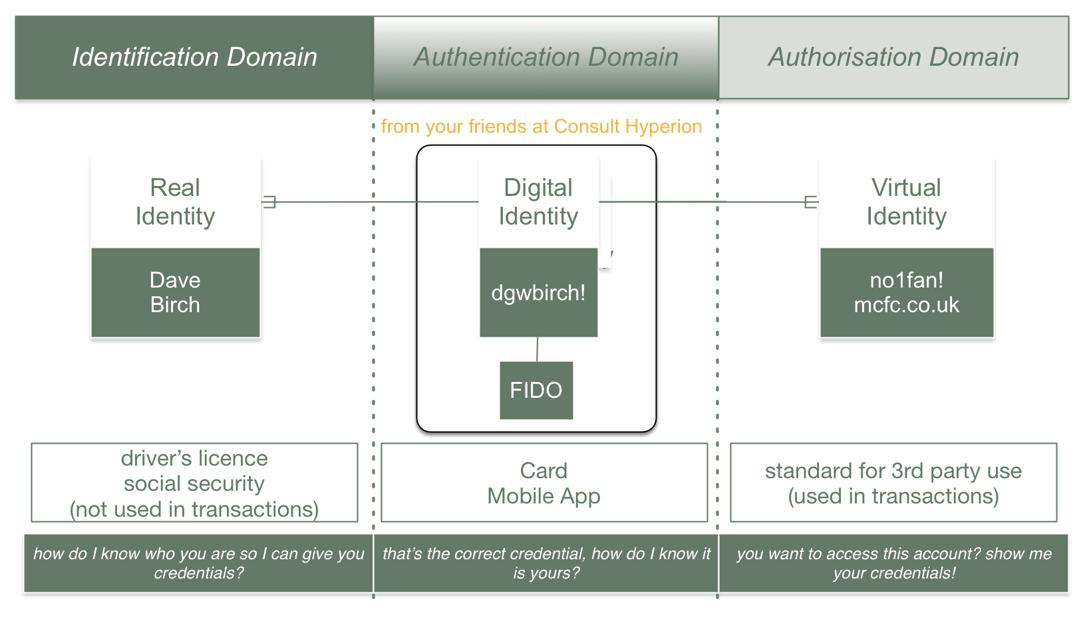

David introduced three identity ‘domains’. He argued we need to minimise the use of ‘real’ identity because of its high costs, such as opening a bank account using numerous unverified documents, and its vulnerabilities to identity theft. Moving away from physical authentication will require collaboration between banks and other industries. The need to develop a secure identity infrastructure will become more pressing as the Internet of Things grows and as we seek to validate our identity to access more services around us.

Chuck provided a Canadian bank’s perspective, including the challenges they are currently facing. He spoke about the importance of building a digital identity ecosystem and the need to leverage consumer trust to put banks at the centre of digital identity. This will benefit the wider economy by removing transaction friction. It will also give consumers control over their data as we enter an era in which this will be increasingly monetised. For example, the heartbeat information collected by smart watches is valuable for some companies (e.g. health insurance) – those wearing the watches should benefit from this (e.g. lower premiums) and be confident in the security of such data.

Chuck went on to describe how Toronto-Dominion Bank is testing the waters as a digital identity enabler. They are developing a product called RenTD to reduce the paperwork (friction) between landlords and tenants. The RenTD approval process for rental applications is fast and simple and the deposit and monthly payments can be fully automated. RenTD makes use of data the bank already holds, adds data from other sources (e.g. criminal record checks) and is mobile-optimised to meet the needs of today’s consumer.

Andre then described how in Canada SecureKey aims to “make identity work as a nation, since identity is bigger than any one single organisation”. The average consumer has usernames and passwords with 130 different entities. Piecemeal responses to rising fraud, such as the use of biometrics, are only a partial answer to the digital identity puzzle. SecureKey’s technology involves a collaboration between banks, government organisations and other industry players to break down bureaucratic silos. Security is key to this, and SecureKey is building this into its system through the use of triple blind authentication and technologies such as blockchain. Consumers will be able to use the network to instantly verify their identity for services such as new bank accounts, driver’s licenses or utilities. SecureKey’s product is scheduled to go live in Canada later this year, but they’re already looking at opportunities for international collaboration.

Chuck concluded the seminar by linking digital identity back to payments and financial institutions, since being a central part of the digital identity infrastructure will allow banks to maintain a presence in transactions. This will create new opportunities for value-added services, such as escrow and credit options. Solving the identity puzzle doesn’t just help combat today’s problems, such as fraud and transaction friction, it also presents new opportunities to meet the demands of tomorrow’s consumers.