Are our payment systems as good as we think they are?

1 Apr 2015

Perception vs reality

We all have the perception that NZ has great payment systems. All the indicators seem to be there: Kiwis are electronically savvy, we’re heavy cards users, most of us use online banking, and cheques are used less and less. But the reality of how good our payment systems are often only strikes us when we travel overseas and experience the hassles of paying in other countries. If we were to challenge the perception that NZ has great payment systems, how can you really measure it and prove it? And if it can be proved, so what? This article takes a brief look at answering these two questions.

Just how good are NZ’s payment systems?

Quantifying and measuring how good our payment systems are is tricky. Looking around the world there is no single measure or ranking system for comparing one country’s payment systems to another. However, by pulling together a range of existing statistical measures into one place, we can start to form a picture of how effective NZ’s payment systems are. We have collated existing metrics from reputable sources to see how NZ really stacks up. Here are the highlights.

The World Bank’s comprehensive Global Financial Inclusion Database1 (164 countries) shows that NZ ranks:

Work/sales income payments into bank account: 1st

73% of adults use their accounts to receive payments from work or selling goods. (Australia is second at 69%)

Banked population: 3rd in the world (behind Denmark and Finland)

99.4% of adults have an account at a formal financial institution.

Debit card penetration: 3rd (behind Netherlands and Sweden)

93.8% of adults have and use a debit card.

Electronic payments usage: 4th

83.23% of adults use electronic payments when making payments

Measures of NZ’s payment system effectiveness from other sources include:

Electronic debit and credit payments per capita: 1st

121 electronic (non-card) payments per person per annum is the most in the world, followed by Sweden’s 115.2

Transactions per capita per annum for debit and credit card purchases: 1st

Approaching 1 transaction per day per capita.3

Cash in circulation: 1st

The lowest banknotes per capita at NZ$1,035 per capita.4

1st lowest total cash as % of GDP at 2.1% of GDP.5

Pace of electronic change: 1st

NZ has the most preferrable mix of consumer payment behaviours being: predominately electronic, fast adoption of electronic payments, and a high preference for electronic payments.6

The above data points clearly show that NZ’s payment systems stack up to be one of the most effective, successful and widely used in the world. These figures confirm that the reality does match the perception that NZ is a world leader in how we pay. But so what? Why does this matter and how does this help NZ? The answer relates to the role payment systems have in an economy.

The effect of payment systems on the Economy

In October 2014, Payments NZ identified and examined the high correlation between our payments statistics and NZ’s GDP. We proved, to a very high statistical confidence level, that Payments NZ’s payments statistics are a powerful predictive tool of GDP 6 months into the future. However, the relationship between payment systems and GDP does not stop with a statistical correlation. Effective payment systems also make a significant direct contribution to the economy and GDP itself.

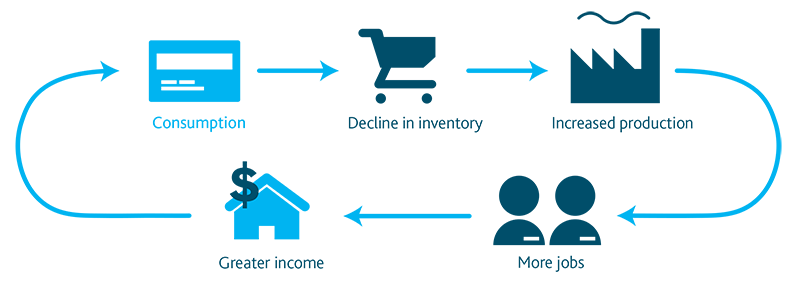

Good payment systems help create a virtuous economic cycle by increasing the opportunities and convenience for consumers to spend by having easy, safe and quick access to their funds. This enables greater consumption and increased sales, which sees inventories decline and production increase. Plus jobs are created which expands personal incomes. This cycle continuously loops, increasing consumption further (and therefore increasing GDP). This is neatly captured in the diagram below.

FIGURE 1: Economic Cycle

SOURCE: Moody Analytics, The Impact of Electronic Payments on Economic Growth

However, the flip side of this is that countries with an inefficient payments mix create a drag on GDP. For example, many of the countries that did not do well in the GFC have very cash centric societies with slow, paper based payment systems.

A Moody’s Analytics study called 'The Impact of Electronic Payments on Economic Growth' 7 provides specific examples of how electronic payments remove friction from our economy, and contribute to higher consumption and GDP. Some of these examples include:

- Increasing the pool of customers who transact and have available funds (including access to credit).

- Creating operational efficiencies and straight through processes.

- Cards enable NZ’s tourism industry with visitors able to access their foreign funds on-demand.

- Eliminating the costs, operational burdens and risks associated with cash and cheques.

- Reducing NZ’s total active cash float, keeping NZ’s ‘spare change’ where it can be used more effectively.

- Electronic payments attack the grey economy by leaving transparent audit trails, which increases NZ’s taxation revenues.

- Electronic payments increase New Zealander’s financial inclusion in the digital economy. The digital economy is an important economic enabler which is estimated to have accounted for one-fifth of all GDP growth over five years in developed countries.8

The same Moody’s Analytics study quantifies the stimulation effect credit and debit cards have on economic growth found:

- Card usage raised consumption by an average of 0.7% across the 56 countries studied with NZ ranked 4th in the world at 1.1%.

- NZ’s greater card usage contributed an additional US$3.2 billion or 0.64% to NZ’s GDP (ranked 6th in the world). To put that in context, the NZ diary industry contributed four times more to NZ’s GDP at 2.8%.

The above statistics truly highlight the positive impact cards have on the NZ economy. When we extend consideration of payment systems’ positive stimulation effect on the economy to include non-card electronic payments as well (where NZ ranks 1st in the world for electronic debit and credit payments per capita9), you know for sure that NZ’s payment systems are making a significant contribution to our economy.

Have New Zealand’s payment systems reached a pinnacle?

Since NZ already stacks up so well on electronic payments, can further economic gains be made? The short answer is yes; there are still significant economic gains to be made. Countries like NZ, with established payments networks, enjoy a greater multiplier effect for any incremental gains made. This is called elasticity. For NZ’s established and already successful payment systems, the elasticity effect acts like a bonus on top of all the other economic benefits. NZ easily tops the world in this elasticity metric, where every additional 1% change in card penetration (NZ currently has 93.8% card penetration10) will add 0.055%11 bonus growth to NZ’s GDP, which is about an extra $100m per annum.

The same elasticity principle would also apply to NZ’s world leading non-card electronic payment system, where any incremental further improvement and usage penetration would deliver significant economic benefit (although this has not yet quantified).

Payments NZ is proud of how effectively our payment systems serve Kiwis and facilitate our economy in action. However, we cannot be complacent. There is an incredible amount of change and innovation occurring to payments around the world, with many countries on a trajectory set to surpass NZ. We have an opportunity to take stock and reflect on how this change and innovation might impact our own payment systems.

Payments NZ is taking stock by embarking on a strategic initiative called Payments Direction. This initiative has been set up to examine global trends and issues in order to take a view on the future of our payments ecosystem and to determine the work we will need to do to retain NZ’s standing as having world-class payment systems. If you want to know more about our Payments Direction initiative, email us at connect@paymentsnz.co.nz or call us on (04) 890 6750.

Footnotes:

1. World Bank, Global Financial Inclusion Database.

2. Lipis Advisors, 2014, Global Payment System Analysis, page 21.

3. Mike Wilkinson, Demand for Payment Instruments How would you like to pay?, page 21.

4. Payments NZ, What is Really Happening With Cash In New Zealand.

5. APCA Evolution of Cash study, page 17.

6. RFI, RFI Global Payments Evolutionary Study 2014, page 9.

7. Moody Analytics, The Impact of Electronic Payments on Economic Growth.

8. McKinsey, 2011, Sizing the Internet economy.

9. Lipis Advisors, 2014, Global Payment System Analysis, page 21.

10. World Bank, Global Financial Inclusion Database.

11. Moody Analytics, The Impact of Electronic Payments on Economic Growth.