Since our last company update in August, we’ve progressed a range of significant initiatives. As we come to the end of another busy year, we’re taking the opportunity to reflect on those initiatives and the year that was.

In no particular order, here are our 2018 highlights plus a glimpse into what we’ve got on in 2019 and beyond.

Connecting the industry

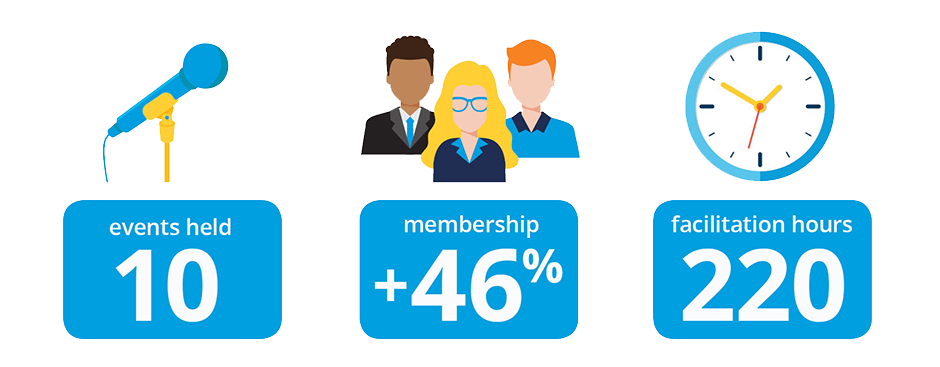

Connecting the industry is one of the most important roles we play. We’re in large part facilitators and connectors, bringing people together from across the payments ecosystem regularly to connect and contribute to industry work. We do this in a number of ways including through industry events, working groups, committees, advisory groups and forums.

This year, we’re really proud to have:

- Facilitated over 110 Payments Direction working groups totalling 150 hours and involving more than 90 people from across the industry.

- Had our clearing system Management Committees, operational forum, and working groups meet over 30 times and spend more than 70 hours working on a range of core system improvements.

- Grown our membership base by 46%, welcoming 11 new Members on board. We also welcomed a new direct settlement Participant.

- Held our most successful conference yet, The Point 2018, with over 360 attendees.

- Ran a total of 10 industry events across the year. Most recently, The Hub and special edition The Link leadership workshop all attracting over 190 people.

- Had our Top Reads weekly newsletter read more than 12,500 times.

Innovation that counts

Innovation means different things to different people. We believe innovation counts when it can ultimately deliver results that benefit Kiwis. Payments Direction, our cornerstone strategic initiative, is one of the key ways we’re working with the industry to deliver a future where Kiwis will be able to pay who they want, when they want and how they want.

A significant innovation we’ve worked on with the industry is developing a shared API framework and pilot. We’re looking forward to a future where common payments-related API standards will increase the ease at which organisations can partner with financial institutions, and bring innovative services to market more simply and quickly. All things which will pave the way for greater innovation.

In the New Year we’ll share some insights from the API pilot and what the next steps are for this industry initiative.

We also continue to progress our other Payments Direction initiatives.

Since our last company update in August, the next phase of the proxy ID workstream has kicked off and a technical working group has been established. This group will be working on the technical requirements of what a central repository for a proxy lookup model could look like.

Our speeding up working group agreed on an aspirational definition of a "fast as" core retail (Settlement before Interchange or SBI system) payment. They defined it “as fast as” an end-to-end “intra-bank” payment. This speaks to the idea that payments should flow as quickly between different banks as they do within the same bank. The group also investigated a potential high level framework for a “fast-as” inter-bank experience. This work will continue in the New Year, including looking into opportunities for how this aspiration can be achieved.

There’s more coming up for Payments Direction next year too. As well as the in train workstreams, we’ll also be kicking off the request-to-pay and informative transactions workstreams, preparing a 2019 substantive environmental scan report and looking to re-set our Payments 2025 roadmap out to 2030.

Check out the Payments Direction journal on our website for regular updates from our working groups.

Maintaining the integrity of our core systems

While it may not sound as exciting as creating new innovation from scratch, we’re always looking for ways to improve New Zealand’s core payment systems and make our rules, standards and processes even more efficient, interoperable and accessible.

Our Management Committees have been busy this year setting out improvements to industry transport ticketing payment guidelines, rules drafting, and risk and compliance management processes. All these developments are vital to improving the speed and efficiency at which we can currently make payments.

This year we released four updated versions of our rules to continue to meet our objective of promoting interoperable, innovative, safe, open and efficient payment clearing systems. Notably, we included amendments to the paper clearing system rules that cater for declining cheque payment volumes, made changes to electronic credit transactions that support the cleared funds initiative, and increased system efficiency for transactions made later in the day.

Our Bulk Electronic Clearing System (BECS) Management Committee took on the governance role for our SBI365 Payments Direction workstream, which seeks to determine the best path towards creating 365-day SBI service availability.

We’ve also been growing our Direct Settlement Participant ecosystem. Most recently we welcomed Bank of China, already a Participant of our High Value Clearing System (HVCS) since 2016, into our Bulk Electronic Clearing System (BECS). We also welcomed the Australian Securities Exchange (ASX) into HVCS as a new Participant.

The Point 2020 – lock it in

We’re excited to announce that we’ve locked in the date at Auckland’s Cordis hotel for our next industry-wide payments conference, The Point 2020. Make sure you save 23 and 24 June 2020 into your calendars.

If you’re interested in getting ahead of the crowd for early conference sponsorship packages or for speaking opportunities, please get in touch with our events manager Liza Beach.